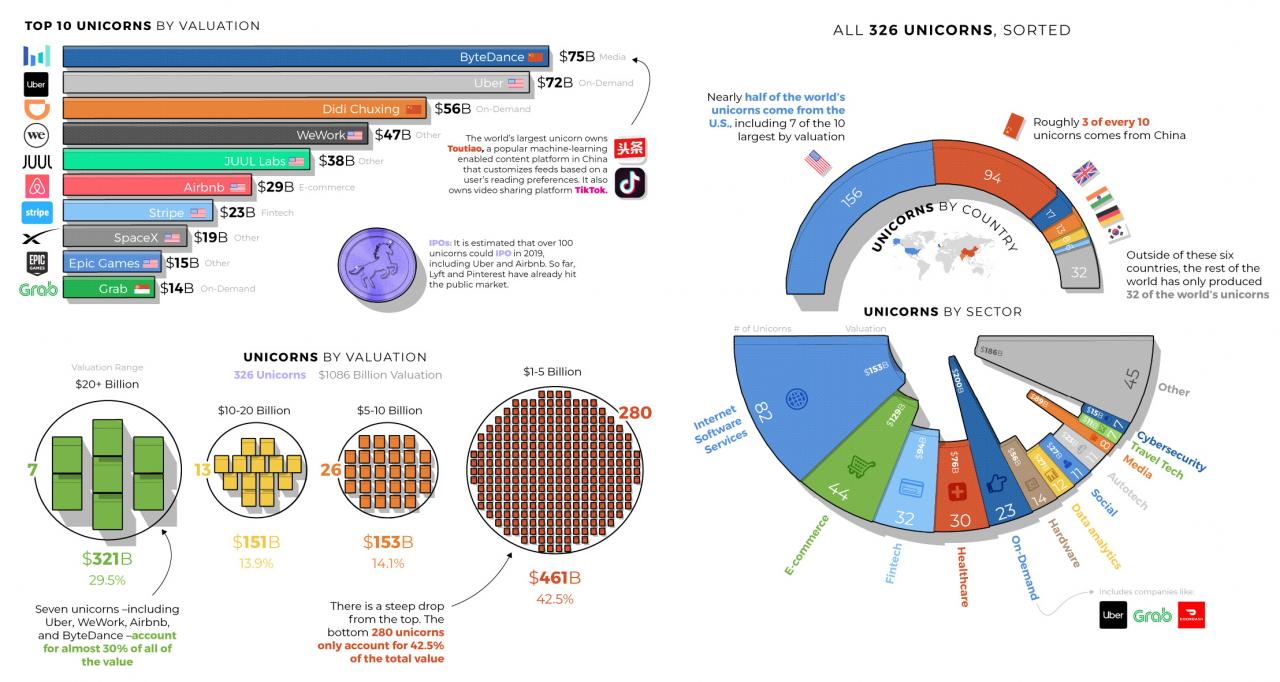

Visualizing the Unicorn Landscape in 2019

It was only six years ago that venture capitalist Aileen Lee coined the term “unicorn” to describe any privately-held startup worth $1 billion or more.

At the time, such valuations were so rare that they deserved a special name – but since then, it’s fair to say that the landscape has shifted dramatically. The startup boom intensified, and capital flowed into private companies at an unprecedented pace.

In recent times, unicorns have multiplied more like rabbits, and investors have propped up the combined value of the world’s 326 unicorns to the tune of $1.1 trillion.

Breaking down the World’s 326 Unicorns

Today’s chart uses data from the Unicorn Tracker created by CB Insights, and it breaks down the unicorn landscape by sector, valuation, and country.

Let’s start by looking at the biggest unicorns currently in existence:

| Rank | Company | Valuation ($B) | Country | Sector |

|---|---|---|---|---|

| #1 | Toutiao (ByteDance) | $75 | China | Media |

| #2 | Uber | $72 | United States | On-Demand |

| #3 | Didi Chuxing | $56 | China | On-Demand |

| #4 | WeWork | $47 | United States | Other |

| #5 | JUUL Labs | $38 | United States | Other |

| #6 | Airbnb | $29 | United States | eCommerce |

| #7 | Stripe | $23 | United States | Fintech |

| #8 | SpaceX | $19 | United States | Other |

| #9 | Epic Games | $15 | United States | Other |

| #10 | GrabTaxi | $14 | Singapore | On-Demand |

ByteDance is the world’s largest unicorn at a $75 billion valuation. The company owns Toutiao, a popular machine-learning enabled content platform in China that customizes feeds based on a user’s reading preferences. It also owns video sharing platform Tik Tok.

Experts are estimating that over 100 unicorns could IPO in 2019, including Uber and Airbnb from the above list.

So far this year, Lyft and Pinterest have already hit the public market – and another recent unicorn to IPO was conferencing platform Zoom Video, which has seen shares increase 120% in price since its impressive mid-April debut.

Unicorns by Sector

The two most common sectors for unicorns are Internet Software Services and E-commerce.

| Sector | # of Unicorns | Valuation ($B) |

|---|---|---|

| Total | 326 | $1,086 billion |

| Internet Software Services | 82 | $153 |

| e-commerce | 44 | $129 |

| Fintech | 32 | $94 |

| Healthcare | 30 | $76 |

| On Demand | 23 | $200 |

| Hardware | 14 | $56 |

| Data analytics | 12 | $27 |

| Social | 11 | $27 |

| Autotech | 11 | $23 |

| Media | 8 | $89 |

| Travel Tech | 7 | $11 |

| Cybersecurity | 7 | $15 |

| Other | 45 | $186 |

However, as you can see, the segment most valued by investors is On-Demand, which includes companies like Uber, Didi Chuxing, and DoorDash.

Unicorns by Geography

Nearly half of the world’s unicorns come from the U.S., but China also has an impressive roster of highly valued startups.

| Country | # of Unicorns | % |

|---|---|---|

| Total | 326 | |

| USA | 156 | 47.9% |

| China | 94 | 28.8% |

| UK | 17 | 5.2% |

| India | 13 | 4.0% |

| Germany | 8 | 2.5% |

| South Korea | 6 | 1.8% |

| Rest of World | 32 | 9.8% |

Strangely, outside of the six major countries listed above, the rest of the world only combines for a measly 32 unicorns – less than 10% of the global total.

Unicorns by Valuation

Seven unicorns – including Uber, WeWork, Airbnb, and ByteDance – account for almost 30% of all of the value of the entire landscape.

| Valuation Range | # of Unicorns | Value ($B) | % of Value |

|---|---|---|---|

| Total | 326 | $1,086 | |

| $20+ billion | 7 | $321 | 29.5% |

| $10-20 billion | 13 | $151 | 13.9% |

| $5-10 billion | 26 | $153 | 14.1% |

| $1-5 billion | 280 | $461 | 42.5% |

The bottom of the pyramid ($1-5 billion in valuation) holds 280 companies. Added together, they are worth $461 billion, which is equal to 42.5% of the unicorn total.